Earned Wage Access and the Income Advance Program: What’s the difference?

The Summary

Employers recognize that financial empowerment is an effective retention strategy.

There is an increase in employers adopting Earned Wage Access (EWA) products, allowing employees to access a portion of their earned wages before their scheduled payday.

When an employee requests an advance through an EWA product, the money is transferred to their bank account and then deducted from their next paycheck. The costs associated with this service may include monthly subscription fees and per-transaction charges.

Alongside the growth of EWA, Direct to Consumer (D2C) Advances have also become increasingly popular. Rather than working with a payroll provider, D2C Advance providers directly link to consumers’ bank accounts.

EWA and D2C Advance products have attracted regulatory concern based on their high cost and complex fee structures. These products have the potential for misuse and create dependency, leading to frequent utilization and higher fees, making it difficult to break the cycle.

Income Advance is an employer-sponsored loan program facilitated through a partnering financial institution rather than an advance on wages earned. This means that the sum borrowed is reflective of what is necessary to cover the emergency expense (up to $2000 rather than what the borrower hopes they can sacrifice from next week’s pay) and it is amortized over a much longer period of time - at least six months.

Income Advance loan repayment is reported to credit bureaus and positively impacts the borrower’s credit score.

While EWA and D2C Advance products offer immediate access to earned wages, Income Advance goes beyond by fostering long-term financial stability through a longer payback timeline, credit building, savings building, and relationship building with local financial institutions.

The higher cost of living and challenges to source and retain employees have been hallmarks of the post-COVID economy many employers are confronting. According to a survey conducted in 2023 by payroll.org, approximately 78% of Americans live paycheck to paycheck, a financial scenario in which an individual or family’s income barely covers essential living expenses like housing, utilities, groceries and transportation, a 6% increase from 2022. Living paycheck to paycheck leaves little room for saving, let alone investing. About 37% or 125 million Americans could not cover a $400 emergency expense. Such financial precarity renders people highly vulnerable to unexpected expenses and even job loss, making them susceptible to predatory lending practices. In this climate, employee retention efforts must go beyond merely providing a regular paycheck to fostering financial stability.

Employers are increasingly recognizing that financially empowering employees who are living paycheck to paycheck is a retention strategy To meet this need, there has been an increase in the number of employers adopting Earned Wage Access (EWA) products, allowing employees to access a portion of their earned wages before their scheduled payday.

At the Rhino Foods Foundation, we get a lot of questions about EWA and how it compares to the Income Advance Program. In this article, we'll delve into expedited pay products (EWA and D2C Advance) and compare them to our Income Advance program. Our aim is to provide readers with a comprehensive understanding to make informed decisions.

What is Earned Wage Access (EWA)?

As the name suggests, Earned Wage Access (EWA) products serve as resources for employees seeking early access to their wages, allowing them to promptly address unexpected expenses, navigate cash flow challenges, and steer clear of payday loans or overdraft fees.

EWA providers partner with employers or payroll processors, integrating with their systems, to facilitate early wage access. Without getting too deep into the weeds, this can be done in two models:

Deduction: The EWA provider advances the earned wage withdrawal, which the employer reimburses to the provider at the payroll cycle's end, thereafter, disbursing the remaining wages to the employee. The employee typically incurs a small service fee to the EWA provider.

Intercept: The EWA provider advances the earned wage withdrawal, and at the payroll cycle's conclusion, the employer directly deposits the employee's full wages to the EWA provider, which deducts the already disbursed wages. The employee likewise pays a small fee, the amount of which varies based on their chosen option.

When an employee requests an advance, the money is transferred to them, subject to predefined limits set by either the employer or the provider. This advance is then deducted from the employee's next paycheck. The costs associated with this service may include monthly subscription fees and per-transaction charges, which could be covered by the employer, the employee, or shared between them. Typical fees range from $5 to $10 per month for subscriptions and $1 to $5 for individual transactions.

Earned Wage Access programs are employer sponsored, meaning they are offered to employees as a benefit. However, alongside the growth of EWA, Direct to Consumer (D2C) Advances have also become increasingly popular.

D2C Advances provide something akin to earned wage access outside of the employee/employer relationship. Rather than working with a payroll provider, D2C Advance providers directly link to consumers’ bank accounts, where their software monitors paydays and cash flow transactions. Consumers can then request an advance if the need arises and, if approved, the provider deposits the advance into the consumer's bank account, to be repaid via electronic debit from their next paycheck deposit or on a predetermined pay date. Some D2C Advance providers offer overdraft avoidance services, prompting consumers to request another advance to avoid overdrafting.

Consumers pay for D2C Advance products through monthly subscription fees, fee per transaction, voluntary expedited fees, or a combination. Typical fees are between $1 to $9.99 for subscriptions and between $1-$5 for individual transactions, varying based on the chosen method of distribution.

While EWA and D2C Advance products offer the advantage of short-term financial flexibility, it's important to understand their complexities to avoid falling into predatory lending practices and a cycle of overspending. Often, EWA and D2C Advance products have the potential for misuse and create dependency, leading to frequent utilization and higher fees, making it difficult to break the cycle.

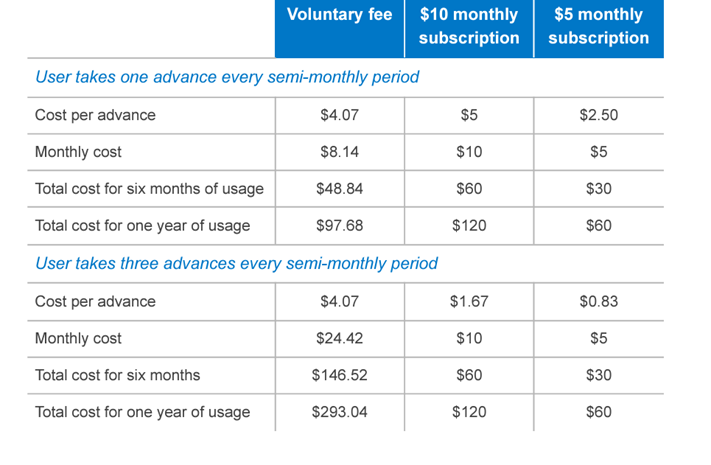

A study from the Financial Health Network found that over 70% of consumers took two or more advances in consecutive semi-monthly periods. From a cost perspective, while a single transaction fee may not seem significant, the average fee in a per-transaction model is $4.07, and when consumers repeatedly request advances, these costs quickly accumulate. The table to the left shows a breakdown of the various fee structures on the market and how costs can add up.

If you are starting to think that this is quickly beginning to sound like a payday loan, you aren’t wrong. PBS recently aired a segment titled: The costs and pitfalls of ‘earned wage access’ apps that offer loans between paychecks, which sheds light on key limitations often overlooked in the marketing of these programs. For those interested in learning more, I highly recommend watching it.

How is the Income Advance program different?

We often say that the Income Advance program was designed to provide all the upside of payday lending without the downsides but, in reality, it goes a lot further in several important ways. Income Advance is an employer-sponsored loan program facilitated through a partnering financial institution rather than an advance on wages earned. This means that the sum borrowed is reflective of what is necessary to cover the emergency expense (up to $2000 rather than what the borrower hopes they can sacrifice from next week’s pay) and it is amortized over a much longer period of time - at least six months.

While Income Advance provides employees with access to emergency funds without the need for a credit check, repayment is reported to credit bureaus and positively impacts the borrower’s credit score - building long-term financial security and opening access to opportunities for future, more favorable financing on products like auto loans or home mortgages.

Like EWA, Income Advance loans ensure emergency funds reach employees within 24 hours and are repaid via payroll deduction, but unlike EWA programs, employees can continue recurring deductions post-loan repayment into a savings account for the employee's long-term financial benefit.

As businesses navigate the evolving landscape of workforce management, solutions like Earned Wage Access and Income Advance demonstrate a commitment to alleviating financial strain for employees. While EWA and D2C Advance products offer immediate access to earned wages, Income Advance goes beyond by fostering long-term financial stability through a longer payback timeline, credit building, savings building, and relationship building. By understanding the nuances of these products and programs, employers can empower their workforce with correct tools to gain financial stability.

Interested in learning more about how Income Advance is right for your business? Feel free to reach out to RFF’s Executive Director, Christina Blunt (cblunt@rhinofoodsfoundation.org) and Income Advance Program Manager, Chris Hynes (chynes@rhinofoodsfoundation.org) to learn more.